This content is restricted to subscribers

A summary of tax changes from April 2018

This content is restricted to subscribers

Tax changes from April 2016

This content is restricted to subscribers

The new tax year 2015-16

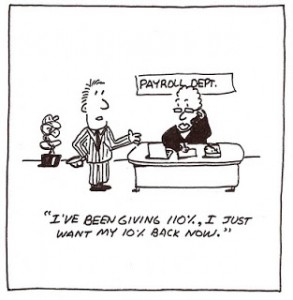

The new tax year 2015-16 is almost with us. There are a few changes for individuals and employers to be aware of.

Income tax

From 6th April 2015 the personal tax allowance will increase to £10,600 for the 2015/16 tax year. Taxpayers will pay 20% on the next £31,785 of their income, so higher rates of tax will be applied to income above £42,385.

A new married couples’ allowance is being introduced from April 2015. This means that if eligible you could transfer up to £1,060 of your allowance to your spouse or civil partner. Your partner would then save up to £212 tax during the tax year. To qualify, one spouse must have a total income no higher than £10,600, and the other must be earning between £10,601 and £42,385. One person per couple can register here https://www.gov.uk/marriage-allowance

Employer’s National Insurance

There is some good news for certain employers for the 2015/16 tax year. The NIC allowance is continuing, so employers will not need to pay the first £2,000 of the 13.8% employer’s national insurance liability. It’s a good idea to check your payroll software is set up to enable this deduction.

Also, from April 2015 employers’ NICs on payments to employees aged under 21, and apprentices under 25 will be nil, on salaries/wages up to £42,385. The normal 13.8% rate will apply to amounts in excess of that threshold.

The NIC deducted from employees is not affected by the above.

Pensions

There have been wide-ranging changes to the way people can pay into pension schemes and withdraw cash. The tax savings or consequences of your decisions could be significant, and you are strongly advised to seek advice from a regulated financial advisor before making any changes, or simply to review your pension status.

Payroll reporting

Penalties for late submissions of PAYE reports (RTI / FPS / EPS reports submitted online on or before the wages/salaries payment date) are due to begin in March 2015. 3 days’ grace will be allowed for employers with fewer than 50 employees.

Penalties start at £100 per late return, further details are here https://www.gov.uk/what-happens-if-you-dont-report-payroll-information-on-time

Auto-enrolment pension schemes

Between now and 2017 employers with small numbers of employees will be contacted by the Pensions Regulator, and will need to have a compliant pension scheme for all eligible workers. Employers should ensure they understand their obligations and act in plenty of time to set up a scheme before their compulsory staging date. The staging date is the date on which employees must be enrolled and the scheme begins. Information can be found on the Pensions Regulator website, and/or from your financial advisor. http://www.thepensionsregulator.gov.uk/employers.aspx

If you would like any help with any of the above please contact us.

Autumn Statement 2014

The government expects future growth to come from smaller businesses and targeted a significant proportion of the autumn statement towards them.

Small business measures included reducing employment taxes and encouraging apprenticeship schemes for the under 25s, as well as a review of business rates.

PERSONAL

INCOME TAX

The personal tax allowance will increase to £10,600 a year from April 2015. The higher rate threshold will rise from £41,865 this year to £42,385 next year.

ISAs

The annual ISA allowance will increase to £15,240 a year from April 2015. ISA savings that are inherited by a surviving spouse from a deceased partner will retain their tax-free status.

PENSIONS

The 55% tax on unused inherited pension pots will be scrapped. People who die before they are 75 will be able to pass on joint life or guaranteed term annuities tax free.

RESIDENTIAL PROPERTY STAMP DUTY

The way stamp duty is applied to residential properties will change to a marginal rate system. From midnight on 3 December 2014, rates will only apply to the proportion of the property price that falls within each band. The rate will be 0% on the irst £125,000, rising to 12% on prices above £1.5 million.

BUSINESS

BUSINESS RATES

Small business rate relief will be doubled for another year. The inlation-linked increases to business rates will be capped at 2%. There will be a review of the structure of business rates. The business rates discount for certain high street shops will increase by 50% to £1,500.

RESEARCH AND DEVELOPMENT

Research and development tax credit will increase to 230% for small and medium sized businesses and 11% for large firms.

NATIONAL INSURANCE

Businesses will not have to pay national insurance contributions when they hire apprentices who are under 25, up to the upper earnings limit. National insurance contributions for employing anyone under 21 will be abolished from April 2015.

OTHER ANNOUNCEMENTS

TAX AVOIDANCE

A continued crackdown on tax avoidance and evasion will raise at least £5 billion in the next parliament.

VAT REFUNDS

Hospice charities, search and rescue services, and air ambulances will benefit from VAT refunds.

CARERS

Carers will be included in the employment allowance which reduces employer national insurance contributions by up to £2,000.

FUEL DUTY

The freeze on fuel duty will continue.

The government has published the autumn statement documents here, for anyone who would like more information. The effect of changes on your own tax situation will depend upon your own circumstances. If you would like to discuss how any changes may affect you or your business please get in touch.

Payroll changes 2014-15

Payroll changes 2014-15 are the usual updates to tax codes, tax rates and NIC rates. Good news includes a delay in the implementation of late filing penalties under the RTI system, and a £2,000 reduction to employer’s NIC. On the downside, employers will no longer be able to reclaim SSP paid to employees.

Payroll changes 2014-15 are the usual updates to tax codes, tax rates and NIC rates. Good news includes a delay in the implementation of late filing penalties under the RTI system, and a £2,000 reduction to employer’s NIC. On the downside, employers will no longer be able to reclaim SSP paid to employees.

RTI LATE FILING PENALTIES

The penalties for late filing of the FPS files which were due to commence April 2014 have been postponed until October 2014.

The FPS files are the Real Time Information (RTI) reports sent each pay period and are due on or before the pay date. The fines are per late FPS and depend upon the number of staff you have:

Staff Monthly Penalty

- 1 to 9 employees £100

- 10 to 49 employees £200

- 50 to 249 employees £300

- 250 or more employees £400

The penalty notices will only be sent out quarterly ,so the bill could be quite high when you receive it. Payment is due within 30 days of the notice.

Where an FPS is late for more than 3 months and the information is not included on a later submission a further charge is made – 5% of the Tax/NICs which should have been on the submission.

SSP RECLAIM ABOLISHED

From April 2014 the reclaim of SSP will be abolished. You still need to keep a record of SSP paid in the normal way but there will be no reclaims at all. Reclaims for SMP, SPP and SAP remain the same.

TAX RATES 2014-15

The new standard tax code is 1000L

Tax Bands:

- 20% £1 to £31,865

- 40% £31,866 to £150,000

- 45% £150,001 and above

NIC Thresholds 2014-15:

Payments start from the primary threshold: weekly pay of £153, monthly £663, annual £7,956

Employees deductions are 12% on amounts above the primary threshold, up to £805 weekly/ £3,489 monthly then 2% on all other earnings

Employers liability: 13.8% on all earnings above the secondary threshold (values are the same as the primary threshold mentioned above).

The threshold for statutory payments is £111 per week.

SSP rate £87.55 per week

SMP/SPP/SAP standard rate £138.18

Student loans are recovered at 9% on earnings above: weekly £325.19 , monthly £1,409.16 or annual £16,910.00.

£2,000 NIC ALLOWANCE

HMRC are introducing a £2,000 Employers Allowance to be offset against your Employer’s NIC. Most employers are eligible for this and we will be taking it into account on your monthly PAYE Summaries.

There are a small number of employers who are not eligible and you can check your entitlement by logging on to the following website:

https://www.gov.uk/employment-allowance-up-to-2000-off-your-class-1-nics